It’s National Moving Month!

Let the celebration begin! May is the start of the summer moving season, when almost 60% of U.S. moves take place.

Did you know that people move an average of 11 times in the U.S.? That’s a lot of packing and unpacking! Driven by more remote working policies, the desire for a higher quality of life, a lower cost of living, and being closer to friends and families, nearly 1 in 5 people are planning or considering a long-distance move as we head into the third year of a pandemic.

The Mover’s Choice team celebrates the hard-working movers and their insurance brokers this month and throughout the entire year. We are proud to be a part of this vital industry.

ATA Celebrates National Moving Month with a Video

American Trucking Associations and the ATA Moving & Storage Conference are celebrating National Moving Month by recognizing America’s moving professionals and providing consumers with a list of helpful tips. Learn more at www.moving.org.

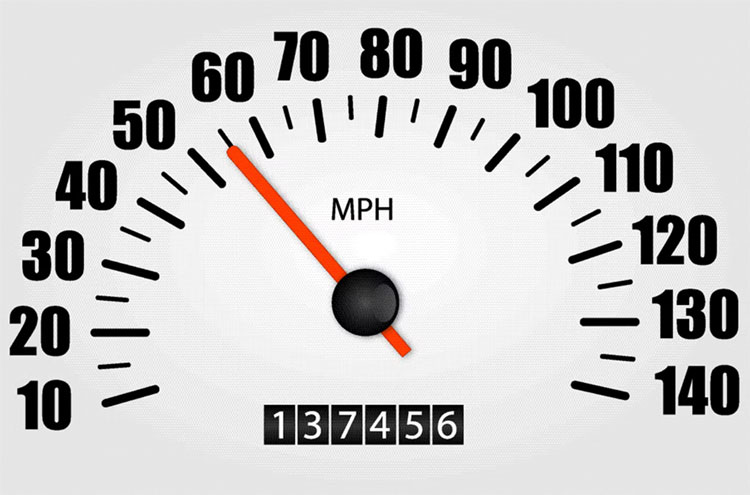

Feds Re-engaging on Proposed Rule to Require Speed Limiters on Trucks

The Federal Motor Carrier Safety Administration issued a notice in April that it was moving forward with a controversial proposal that has languished since 2016: requiring speed limiters on commercial motor vehicles.

Implementation of Household Goods Working Group Recommendations

The Federal Motor Carrier Safety Administration is amending the Transportation of Household Goods regulations to incorporate recommendations from the Household Goods Consumer Protection Working Group. The Agency is also making additional minor changes to increase clarity and consistency. The updates will result in an aggregate reduction in costs for household goods motor carriers and provide clarity for individual shippers.

The Heat is On: OSHA Launches Program for Heat Hazards

The Occupational Safety and Health Administration (OSHA) has announced a National Emphasis Program (NEP) focused on heat hazards. Under the NEP, OSHA will be conducting proactive inspections for heat-related hazards—in both outdoor and indoor work environments. Movers, we urge you to review the information and how it may apply to your company. Multiple industries are outlined in the Appendix.

Mitigating Risk of Slips, Trips & Falls

Falls in the workplace accounted for 90,000 injuries and an average of 31 lost work days in 2021. Understanding the risks that lead to potential injuries can help you take steps to mitigate hazards in your work environment.

Welcome Barbara Butchart!

We are very pleased to announce that Barbara Butchart has joined our team as a senior underwriter for Mover’s Choice! Barbara brings a wealth of industry knowledge to the team having worked in this industry for 18 years in underwriting and claims roles. More recently, she has added to her experience as a commercial account manager on the retail side of our business with Lutheran Trust Insurance Agency. Barbara holds a number of designations including AIS, AU and CIC. We are very excited to have her join our growing team!

Coverage Question of the Month:

Are your On and Off-Premises Vaults Adequately Insured?

By Terri Moran, Chief Underwriter, Mover’s Choice

With the increases of materials and labor, I am sure you have seen the rising cost to replace storage vaults. What previously cost roughly $240 is likely $450 per vault, or more.

For vaults that stay on-premises, they should be insured under Business Personal Property limit. Please make sure you assess and update your limits to include an adequate amount to replace these. If your vaults are being covered under Inland Marine, be sure to insure the full value of all the vaults and not just the dollar amount that could be off-premises at any one time. The Inland Marine will cover them both while on and off premises. Think about this, if you’re only insuring the vaults that are on a truck, what happens in the case of a fire at the warehouse?

If the vaults are taken off-premises to load and unload, determine a maximum value that could be off your premise at one time. Your automatic coverages when you carry business personal property do allow for some off-premises exposure up to $10,000, but not while it is on a vehicle, so making sure your Miscellaneous Moving Equipment limit includes this value is important.

Simply put, if the vaults go off-premises on a regular basis, then those vaults should be considered scheduled property. If the vaults stay on-premises, then the vaults should be covered under business personal property.

If you don’t want to insure them at all, be sure to let us know as we wouldn’t want that to impact any coinsurance requirements.

Thanks to my broker and carrier friends who helped me with this article!

~ Terri Moran

If you have coverage questions that you would like us to address next month, please submit your questions to Brandon Laam at . If your question is selected, we will send you a $25 Amazon Gift Card!